Long-term care looks different for everyone. Depending on the type of care you need (and where you’d want to receive that care) it can vary from having a room in a nursing home to having your family members come to your house and take care of you. When we describe long-term care to our members we tend to say it’s the care you need when you can’t do things on your own anymore. Like getting out of bed, going to the bathroom, bathing, cooking meals, etc. This can happen for a variety of reasons, but usually refers to people who have limited mobility due to old age.

Nursing facilities or having someone come and take care of you can be very expensive, these places range from $50,000-$70,000 a year. Which is where long-term care insurance comes in. Basically, Unum covers you by paying you monthly to help pay for care.

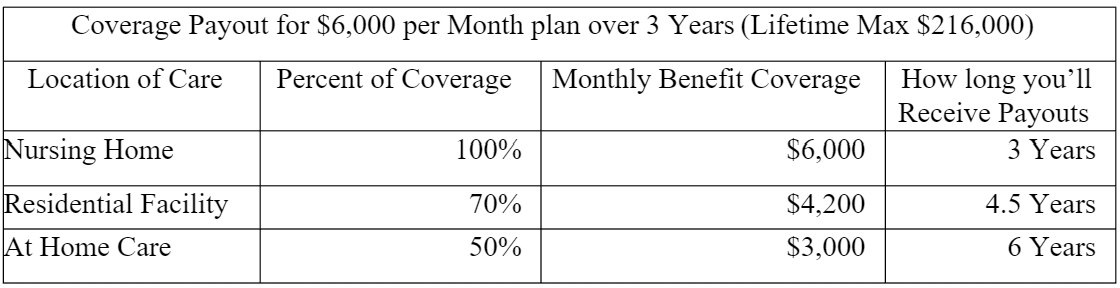

The plan covers nursing homes (100% of your monthly benefit coverage), residential facilities (70% of your monthly benefit coverage), and at home care (50% of your monthly benefit coverage). And don’t worry, you’re not losing money if you seek at home care instead of care in a nursing home. For example, if you select a 6 year plan, if you’re getting at home care you’ll get that payout for 6 years, whereas if are getting care in a nursing home, you’ll only be covered for 3. That might sound complicated, but check out the chart below. In it we are using an example coverage amount of $6,000 per month.

Is Long-Term Care Insurance right for me?

Because this plan is so customizable and adjusts based on your age and health, it should be considered by everyone, regardless of family history. Let’s face it, right now is the youngest (and probably healthiest) you’re going to be, meaning right now is the best time to enroll in something that bases its price on how young you are!

Additionally, if you have a family history of Alzheimer’s or other genetic diseases that require long-term care, then you should consider signing up for this insurance. It’s the safest way to ensure you’ll be able to get the care you deserve without becoming a financial burden.

How much does this plan cost?

There are a lot of factors to determine how much your plan with Unum will cost. We recommend you look at the enrollment calculator here or book a meeting with one of our specialists by clicking here.

How do I enroll?

The best path to enrolling is to go through our Unum specialist. Email Will@SDPEBA.org or sign up for a meeting by clicking here and he’ll walk you through your options, talk you through the rate calculator, and help you make the best choice.

How do I file a claim? How do I use the plan?

Once you are qualified to enter into a long-term care facility or start requiring long-term care services, you’ll begin your 90-day elimination period. Once that’s finished, you’ll stop paying your premium and begin receiving payouts.

Proving you can receive your long-term care insurance is also on your doctor, not you or your insurance. So, if your doctor says you need it, you’ll get it. Once you’re enrolled in a long-term care service you can contact 800-227-4165 and begin the benefit process.

This is also an “indemnity plan,” meaning you’ll receive the full payout regardless of the price of care you receive. That means, if you’re in a nursing home that costs $5,000, but you have the $6,000 plan, you’ll still receive the $6,000.

About Us

The San Diego Public Employee Benefit Association is a partnership of unions and associations designed to help reduce costs, improve benefits, and enhance support for San Diego’s public employees. We’re here to answer your questions and help make sure you get the most out of your benefits while also advocating for you directly to the provider to make sure you get the best experience possible.